When organizations create a Compliance department and get Compliance Officers in, they usually task them with ensuring the organization stays compliant with regulators and also keep customers happy.

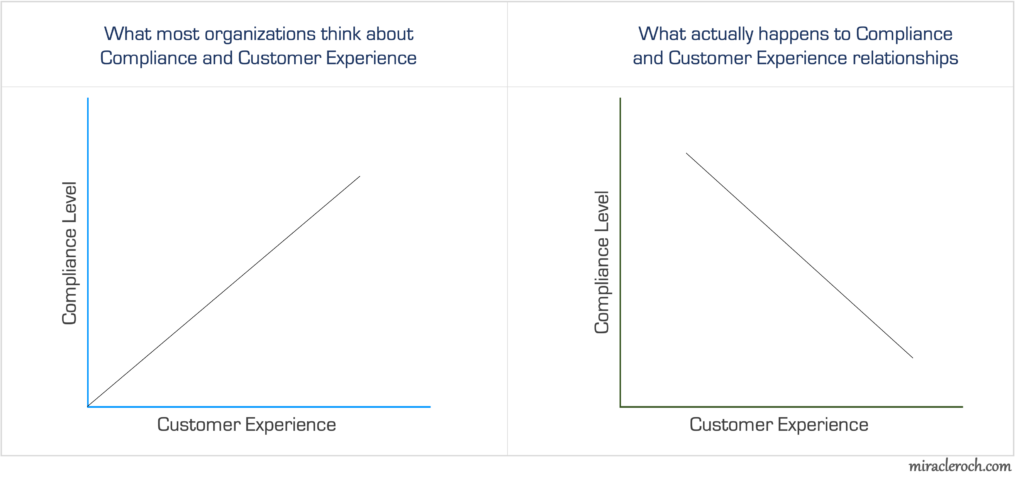

Organizations make the mistake of equating robust compliance processes with a happy customer. Most organizations see the relationship between compliance and customers as a positive linear graph where the more they tighten compliance to provide added security to customers, customers would in turn be happy at the increased measures but that couldn’t be any farther from the truth. Customers don’t like more compliance processes, they want less. They want to access the services you offer in the shortest time possible, any additional “time waster” in the name of compliance only sours their customer experience no matter how you couch it as “increased security”, “trust”, etc.

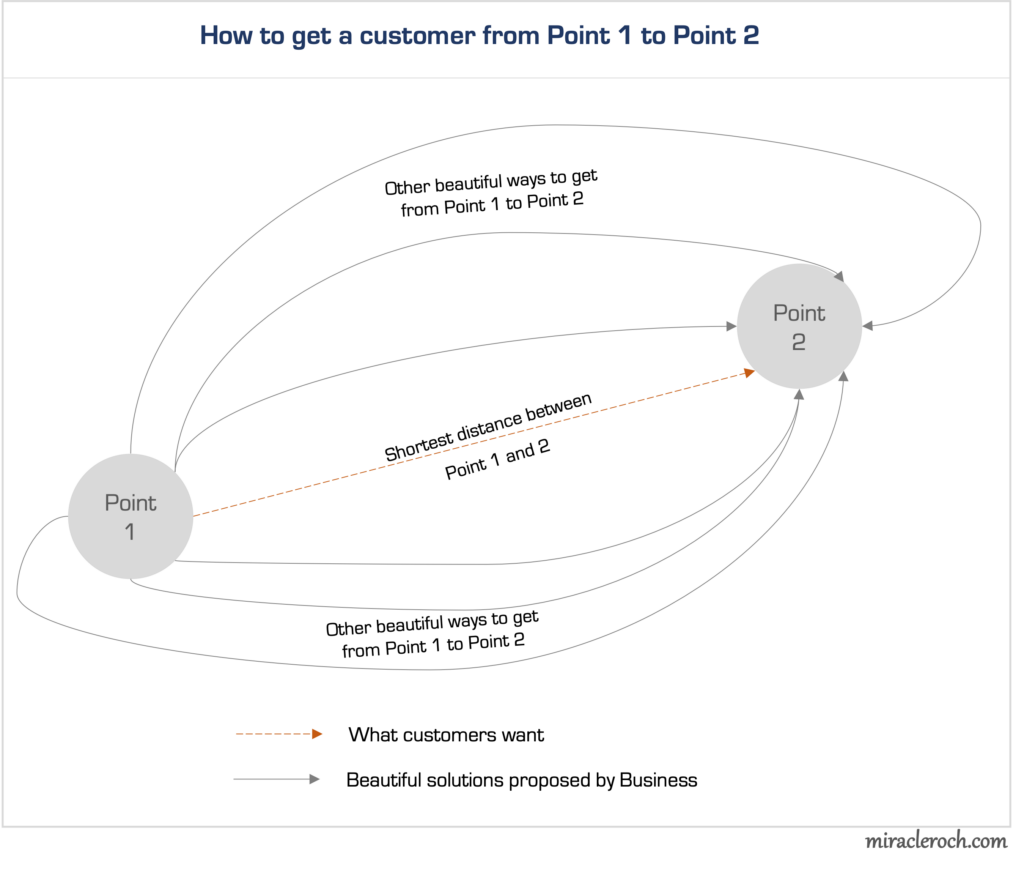

Customers want a seamless customer experience and a service that’s delivered in the shortest possible time. The relationship between customers and service expectation is best described as the relationship between any two points and finding the shortest distance between the two points. A straight line is not fancy but it’s the most effective and shortest way to get between the two points.

Organizations and businesses complicate their customers’ journey map by adding services they feel will matter most to users and thus convolute the whole experience. Before any additional innovation is added to your service offerings, you must ensure the basics are being done right. Most times, customers switch from one business to another because someone is not getting the basics right.

"Customers switch from one business to another when someone does not deliver the basics correctly. Service add-ons are rarely the cause for high customer churn. Focusing on getting your add-ons right while your basics suffer is detrimental to business"

Compliance is a critical aspect of running a business, but customers are also critical and are the lifeblood of any business. So, how do you balance the need for compliance and also keep customers happy? I may have an idea.

Compliance is a critical aspect of running a business, but customers are also critical and are the lifeblood of any business. So, how do you balance the need for compliance and also keep customers happy? I may have an idea.

Compliance is such a critical part of a business that it should never be compromised. Using compliance level as a yardstick to judge customer experience is already a flawed juxtaposition in my view. The ideal thing to do is to find a sweet spot for customer experience where you increase your compliance levels without hampering your customer experience. There are several ways to do this. I am a management consultant and I also work in the Digital Identity industry, building digital products that allow businesses meet their KYC and compliance needs without complicating their process, so I have some first hand experience to share here.

Leveraging technology to build diligently crafted products and increase your compliance levels and seamlessly integrating these new processes with existing customer journeys (without adding more time) is a masterstroke. Organizations should instead focus on refining their compliance process, most compliance officers don’t believe that “less is more”, they instead say “more is deeper” but I think this is archaic. I am not a compliance officer but I am a process, strategy and technology guy. I know that a list of all the requirements from a Compliance Officer can always be streamlined without diluting expectations. So many of the steps proposed by compliance can either be merged into one or met with the aid of technology solutions.

In a nutshell, stop trying to refine your compliance process to make customers happy, focus instead of providing the basics – that is what keeps a customer happy. And then leverage technology to deepen your compliance coverage without any increased complexities. You make customers happy by building trust. You build trust by providing the basics consistently and once trust is achieved, it becomes the cornerstone for increasing compliance.

You make customers happy by building trust. You build trust by providing the basics consistently

Miracle Roch.