On the 26th of October 2022, the embattled Central Bank of Nigeria (CBN) Governor, Godwin Emefiele held a special press briefing. No one knew what the briefing was about, there were wild speculations and true to form; he shocked everyone. “Nigeria, he began, had about 3.27 trillion Naira currency in circulation, N2.73 trillion of that (or 83%) were outside Bank vaults and in the hands of the public. This, according to Emefiele, was a wholesome (sic) trend that cannot be allowed to continue“. This CBN seemed to think this was a huge anomaly. We will get to that soon but to do that, it is important to first, understand the role that currency plays in the economy and why reducing the amount of currency in circulation can be problematic. Currency is a vital component of the economy, serving as a medium of exchange, a store of value, and a unit of account. In order for the economy to function effectively, there must be an adequate supply of currency available to facilitate transactions. The CBN Act of 2007 gives CBN the mandate to maintain a strong and effective legal tender – strong and effective Naira, so this decision definitely falls within the CBN’s purview.

This article is in two parts, the first part will go into a long-winded economics crash course on currency circulation and how that shapes or impacts a country’s economy. The second part will deep-dive into Nigeria’s cashless economy (more on this soon), a central premise for the CBN’s decision.

How does Currency Circulation work?

Contrary to Emefiele’s assertion that this “wholesome” (I think he meant unwholesome) trend cannot continue, there is no defined percentage distribution for a country’s currency in circulation. Milton Friedman is arguably the father of modern-day monetary policy and even he could not offer an ideal percentage distribution. There is no one-size-fits-all answer to this question, as the ideal percentage of a country’s currency in circulation that should stay in the hands of the public versus banks will vary depending on a number of factors, such as the size and structure of the economy, the level of monetary policy, the stability of the financial system, etc. The thing is that if more money stays in the hands of the public as against the banks, it could spur economic growth as people have more cash to power transactions, but the flip side is that too much money can lead to inflation. Nigeria’s inflation is in record double digits and expert economists will tell you the reason for this has nothing to do with the cash in circulation. What happened here, in a similar fashion to other CBN policies, is that the CBN has found a scapegoat for how poorly it has managed our monetary economics. Currency in circulation is the new scapegoat, similar to how the CBN blamed an online FX rates aggregator for being the reason behind the declining value of the Naira against the Dollar. Nothing is surprising anymore from the CBN, especially one that likes to pick small fights, literally.

Where is the Financial Stability?

The institution that should rightly influence the amount of currency in circulation is commercial banks, through innovative solutions in lending and borrowing to rightfully bring money in and then release them, but like so many people know, banking in Nigeria is nonexistent. Our Nigerian banks practice what people have called “shashe banking” and they hardly move the needle in the real economy. Let’s take a quick look at the Nigerian Inter-Bank Settlement System (NIIBSS) fact sheet to support this claim. There has been a steady increase in the rate of inactive bank accounts across Nigeria, showing that Nigerians are getting fed up with traditional banks and embracing smaller fintech alternatives. But the Nigerian banks don’t care seeing as they keep seeing record profits every year. In Nigeria, a country of over 200 million people, there are less than 60 million Bank Verification Numbers (BVNs), the unique identifier for financial service users in the country. In contrast, there are almost 94 million registered voters in the country despite the high barrier to becoming a registered voter (minimum of 18 years). There is no such restriction for the BVN yet we’re barely at the 56 million mark. This should already tell the CBN that there are too many people who have been disenfranchised by the financial system but do not seem to have had any adverse experience as a result. Why do you think this is? Of course, they use cash and thus have had no need to transact with a Bank. More than 30 million people with PVCs do not own bank accounts (probably more given that more BVN enrollees are less than 18). The performance of the BVN is so poor and lags behind all of its comparative databases, including the foundational NIN with over 90 million enrollees. Guess what? Out of the 56 million BVNs, less than 50 million are listed as active. This looks like a good premise to go back to Emefiele’s speech.

In Nigeria, a country of over 200 million people, there are less than 60 million Bank Verification Numbers (BVNs), the unique identifier for financial service users in the country. In contrast, there are almost 94 million registered voters in the country despite the high barrier to becoming a registered voter (minimum of 18 years)

“Furthermore, we believe that the redesign of the currency will help deepen our drive to entrench cashless economy (sic) as it will be complemented by increased minting of our eNaira. This will further rein in the currency outside the banking system into the banking system thereby making monetary policy more efficacious”, continued Emefiele. It looks like he did not read the riot act. What drive? What cashless economy? There are no data to support the claim that Nigeria is a cashless economy. An economy where 83% of your cash in circulation is not sitting in bank vaults cannot be cashless. Do not get me started on the eNaira (more on that later).

Minting the New Notes

Another banger from Emefiele’s speech; “customers of banks are enjoined to begin paying into their bank accounts the existing currency to enable them withdraw the new banknotes once circulation begins in mid December 2022. All banks are therefore 11 expected to keep open, their currency processing centers from Monday to Saturday so as to accommodate all cash that will be returned by their customers” (emphasis mine). Emefiele envisaged a cash exchange programme where people deposited their old notes and took new ones so I guess he must have had a solid plan to ensure an equilibrium between old cash and new cash. Turns out he did not. We had N3.2 trillion in circulation, thus we can roughly assume that 70% of that cash was held in the redesigned 200, 500 and 1,000 denominations, so if the CBN wanted to maintain the status quo, it was expected to mint at least N2.3 trillion worth of new notes. To understand how big an undertaking this is, the CBN minted just N1.3 trillion worth of new notes in all of 2021 – twelve months. And here, the CBN was promising a cash exchange programme that would have required the minting of N2.3 trillion worth of new notes in just three months. Of course, you can already see how impossible this would be, everyone could see it except the CBN. Apparently, the CBN had other plans. They “ordered” for 500 million pieces of new notes to be redesigned (or recoloured perhaps?). If we assume a near-equal distribution across the three denominations, this comes down to a total of about N320 billion worth of new notes. In another press conference, CBN said they had collected 1.9 trillion Naira worth of old notes since the currency redesign kicked in. So, the CBN collected 1.9 trillion Naira from the market and replaced it with just 320 billion Naira. Is anyone still wondering why the currency swap has been so messy and has led to demonstrations across the country? It sure looks like the folks at CBN don’t care about the forces of demand and supply, else in which world is N320 billion enough to substitute for N1.9 trillion. Anyway, of course, we have experts at the CBN collecting juicy and fat salaries, so they did not forget demand and supply, they had a plan. So what was the CBN’s plan? To unravel their plan, keep these two words in mind – cashless and eNaira. Let’s start with the latter.

The Doomed eNaira

What is the eNaira? Launched in October, 2021, the eNaira is a central bank digital currency (CBDC) and the CBN’s attempt to latch on to the disruption and progress being brought about by crypto and blockchain in the financial services industry. Again, like with most things CBN, they imagined that the launch of the eNaira will reduce the demand for physical cash. By all accounts, the eNaira has been a failure as it has faced low adoption, poor utility and failed use cases. So you can imagine the surprise when the CBN Governor mentioned the eNaira as one of the ways to cushion the need for cash. So many people have never used the eNaira because it never works and also does not make sense if you own a bank account. The eNaira does not make sense for the banked and the unbanked do not have access to the tools required to use the eNaira. Street hawkers and market men and women do not know what the eNaira and it’s current form cannot meet their financial service needs and expectations. So the eNaira was never an option at all, the CBN knows this, but it decided to turn a blind eye. What was the result? Disaster.

Cashless Policy

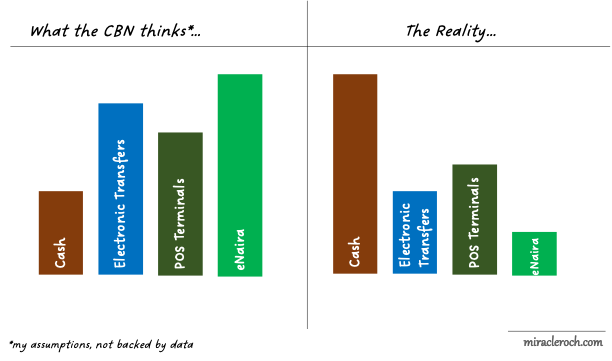

The CBN overestimated how cash reliant the Nigerian economy is. Too many critical sectors of the economy rely on cash. There are too many reasons for this – poor financial inclusion, lack of innovative payment solutions, the unreliability of digital payment systems, education, internet, lack of trust, smartphone penetration, etc. All valid reasons. It is not that people don’t want to switch to cashless systems, in most cases, those cashless systems just do not work, and/or very few people understand how to use them. Here’s what I think happened at the CBN. Let’s go back to our NIBSS fact sheet (the last publicly available fact sheet is for 2021 so we will use that). The CBN must have looked at the fact sheet and seen that electronic payments were made more than 3.4 billion times in 2021, they must have seen that this number (along with the number for POS transactions) has been on a steady rise and they automatically assumed that this was a fair representation of adoption and market sentiment. They failed to look at the universal set of people making these transactions; they were revolving around the same people. In fact, if the CBN had hired me, I’d have told them that the rate at which we were welcoming new people into the financial system was very slow compared to the rate at which we were losing them. A simple Pivot Table analysis could have shown them this. Increasing electronic transaction volume does not equal increased electronic transaction users. Thus, the CBN should have known that “cashless” would not have made up for the N2 trillion cash deficit in the economy. There’s a N2 trillion need for cash in the economy right now and something has to be done about it. eNaira cannot solve it, cashless cannot solve it. It is a sheer problem of numbers.

Reducing the Demand for Cash

To reduce this N2 trillion demand for cash, there are numerous sensible things the CBN would have done before embarking on this currency redesign exercise. While the original intent for the currency redesign may have been good, it’s implementation has been wonky at best and amateurish at worse. I have listed seven things that the CBN should have done before embarking on this venture:

- Create a Payment Terminal Fund – the CBN should have created a PT Fund that would invest grants to companies working within the payment terminal field. This fund will be used to sponsor so many things including:

- Purchase new POS Terminals – POS Terminals are expensive and so not something any small business owner can buy. The fund should have been used to purchase large quantities of POS terminals from OEMs and thus crash the local market price for such terminals. Small businesses would have then been made to apply for one on a portal created and managed by the CBN (all the businesses need to show would be evidence of their tax payments). Issuing this terminal to small businesses for free or at a very subsidized rate would have automatically made these small businesses the biggest proponents of the cashless policy as they would encourage their customers to pay using their cards, thus reducing the overall demand for cash. In the United Kingdom, it takes less than 30 minutes to get an NFC-enabled POS terminal which is why its usage is so rampant. . The CBN should have worked to replicate this ease such that danfo buses, corner shops, hawkers find it easy to get a POS terminal.

- Create an Innovation prize – to be awarded to fintechs (and/or banks) who come up with the best innovative ways of collection offline payments (examples include a solution that allows for NFC payments thus reducing the need to input a pin all the time and abolish the annoying “savings or current” question POS operators ask all the time, another example is a solution that integrated ApplePay and GooglePay and allows users pay with their mobile phones, etc.). This Innovation prize would have incentivized a lot of our smart and young fintechs to come up with innovative solutions to alleviate the demand for cash.

- Most merchants shy away from POS terminals because of the hidden transaction charges that come with them. A portion of this fund could have also gone into writing off some of these hidden charges to encourage rapid merchant adoption

- Banks are currently the biggest suppliers of POS Terminals through their various Agent networks (FirstMonie, Closa, etc). While they have done a lot, they can still do more. The CBN should have given Banks a target number of POS terminals that they should distribute within a short period. The criteria can include giving one free Terminal to any business account that has made at least 10 transactions in the last three months.

- Abolish Electronic Transfer Fees – electronic transfers today come with all sorts of taxes and fees that sometimes discourages retailers from paying merchants via electronic transfers. The CBN should have abolished all fees and taxes on electronic transfers for the next six to twelve months to drive up the usage of electronic channels. Freebies work well in Nigeria so this would certainly be embraced.

- Increase Tax on Cash-based Transactions – The CBN introduced a cash tax over a year ago and this would have been a good time to hike those taxes once again. Given that the CBN and the Nigerian Government would have lost some revenue from the electronic transfer waivers suggested above, a hike in cash-based transactions would have gone a small way in helping soften that hole. The CBN’s goal should have been to make cash transactions undesirable and expensive as this would disincentivize people from seeing cash as their default transaction means.

- Telco Partnership – No one understands distribution better than the Telcos. The Telcos have found a way to manage their retailers and mop up cash in a seamless manner and they have been at it for years. The recent banking license given to Telcos allows them play in the financial services space. The CBN should have gotten into an agreement with Telcos and supported them in creating solutions that allow payments to be made over USSD, phone calls, SMS, etc all while relying on existing Telco rails and not banking rails. There are more than 140 million Telco customers in Nigeria compared to just 55 million banking customers so I know the rails that I’d be looking to target if I wanted mass adoption of anything.

- Increase circulation of the smaller denominations – one of the striking things about the current cash crunch in Nigeria has been the absence of even the older notes that were not redesigned (the N100, N50, N20, N10 and N5 denominations). The CBN should have made adequate arrangements to increase the circulation of those notes to ease the demand for cash in places where they are inevitable.

- Mint More Notes – Quite simply, the CBN’s current order of ~N320 billion worth of new notes is absurd especially when you think about the demand. The CBN should have targeted the goal of minting at least N1 trillion worth of new notes and hope that the other initiatives would be sufficient to lap up the other N2 trillion.

- Remain Apolitical – The whole currency redesign process was masked with politics from day one and I don’t think the CBN has done a good job of shying away from the political undertones that accompanied the policy. It is election season in Nigeria so any major policy change is bound to be viewed with scepticism which is why it is very important to stay apolitical and garner support across the aisle so as not to alienate the folks across the divide.

Conclusion

The CBN’s assumption that Nigeria can quickly and easily transition to a cashless economy is misguided and fails to take into account the reality of the situation. While it is true that many countries around the world are moving in this direction, Nigeria is not yet ready for such a transition, and a more gradual approach is necessary. The country must first address the lack of access to digital payment methods, as well as the inadequate infrastructure and support systems necessary for a cashless economy.

In conclusion, the CBN’s new currency redesign program is a poorly thought-out approach that fails to take into account the realities of the Nigerian economy and the programme should be rethought, as it risks having serious consequences for the country’s economy. Instead of reducing the amount of currency in circulation, the CBN should take a more gradual approach and focus on addressing the underlying challenges that are preventing the country from transitioning to a cashless economy while ensuring that there is still an adequate supply of currency available to facilitate transactions. They should also focus on increasing access to non-cash methods of payment (like I listed above). Until Nigeria is ready for a full transition to a cashless economy, reducing the amount of currency in circulation could have damaging effects on the country’s economic growth and stability.

Over here, we pray things do not fall apart due to the inability of the centre to “hold”, citizens do not descend into anarchy and that somehow, the Nigerian resilience powers through as we find a solution.

Stay True.

Miracle Roch. (sic